Update with which trading zones to which German Real Estate Action. Diese Marken muss man know. Professionelle Marktteilnehmer locken Privatanleger in Falle!

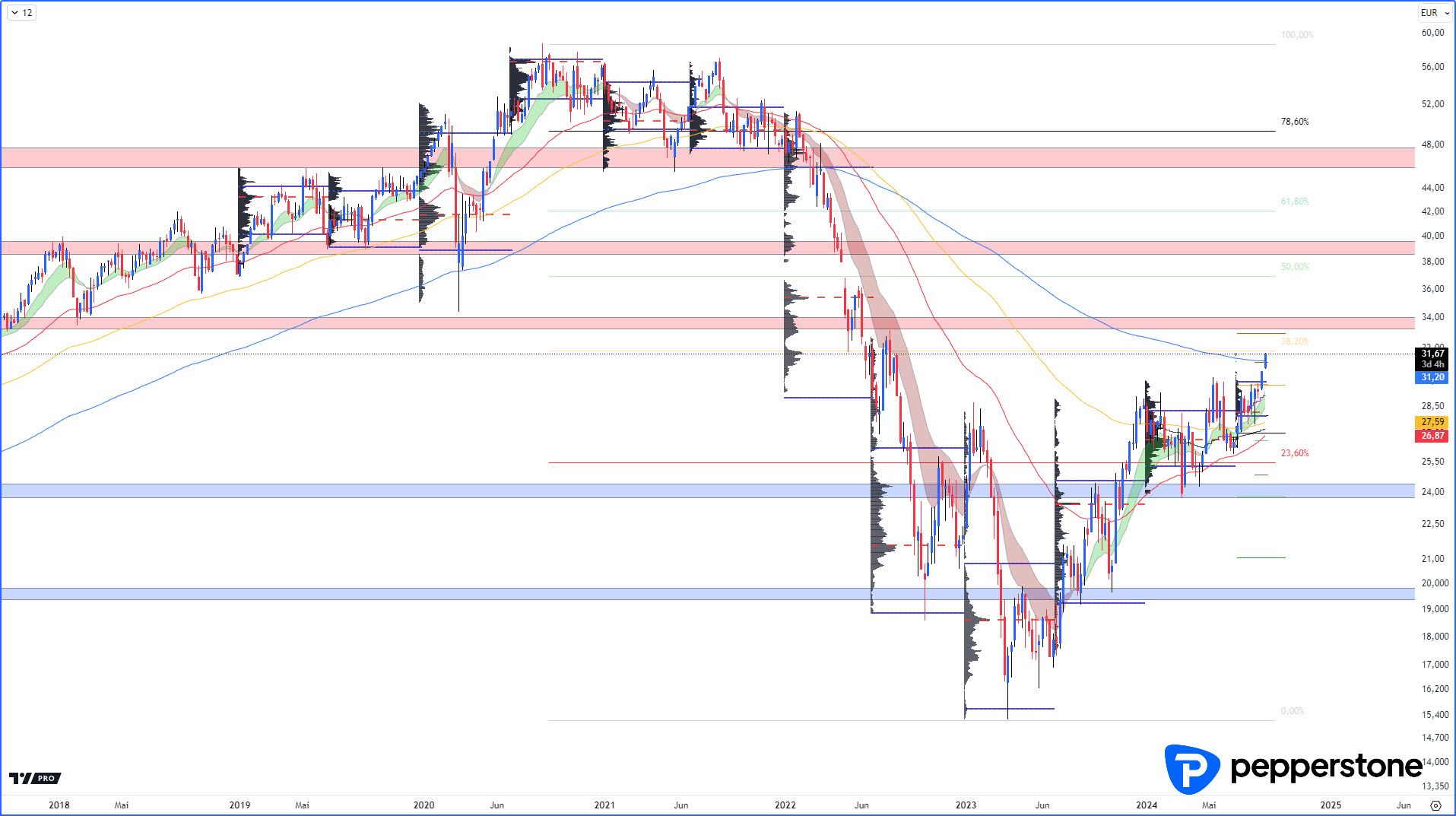

VONOVIA – W1 map | 27. AUG. 2024

Hauptwiderstand EUR 34.00 If the real estate price now has a direction, the Aktie von Vnovia (ETR:) will take a look at the Räder in 2022. From a 53 euro bag of paper to 15 euros within a year. Now you can use a lighter effect and create a dynamic soul-cutting effect. Is the trend turn or the dream here a crash?

Before investors harmonize when the situation arises, after they take over the German Action, war is waged. However, if it is not the case that something is happening, it is not. If anyone had come up with something, it was clearly an outperformer of the German index in the current times, it is of course one of the less sustainable results.

Wichtige Unterstützungen: 20.00 EUR | EUR 24.00

White wider stand: EUR 34.00 | EUR 39.00 | EUR 46.50

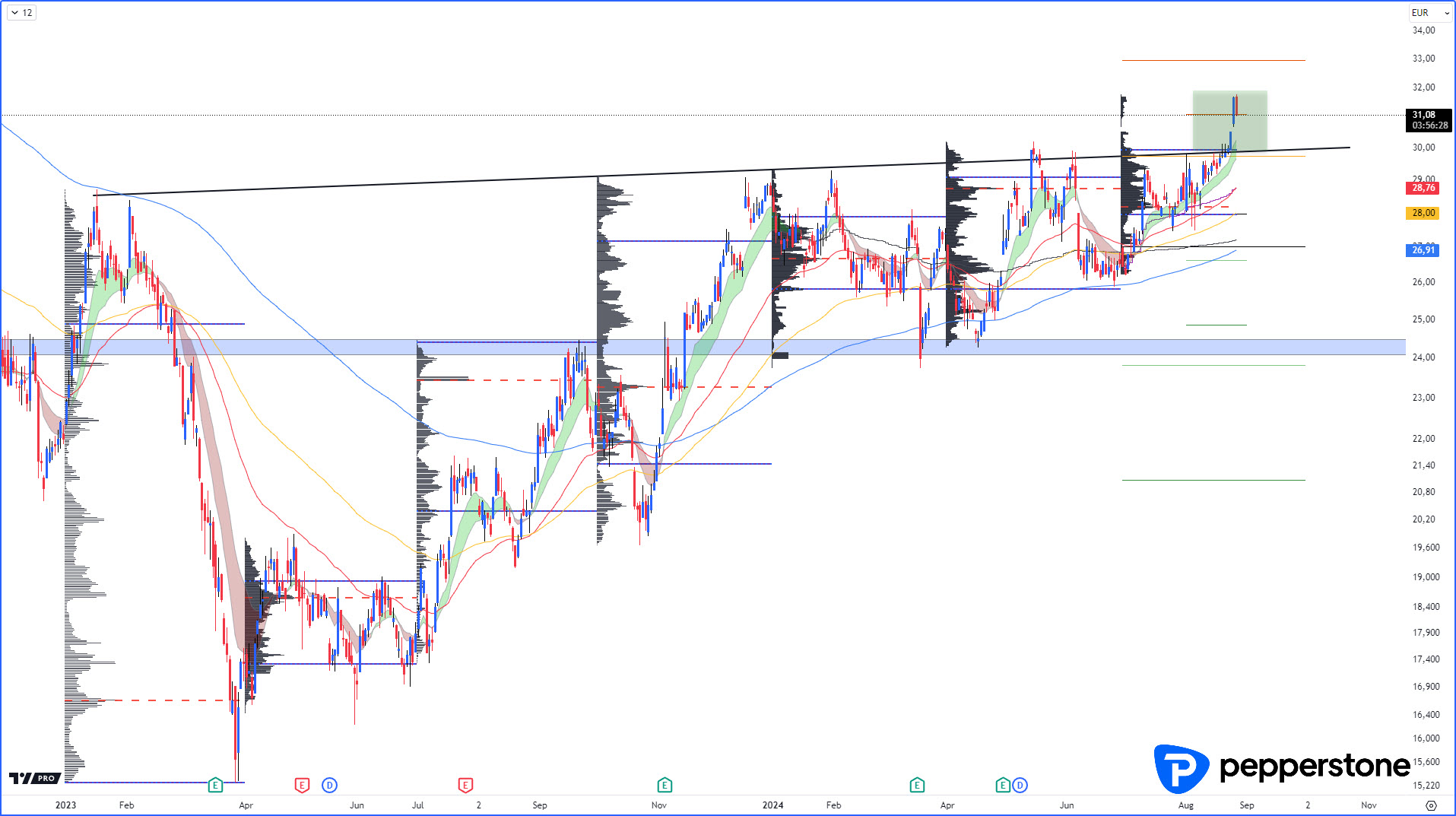

VONOVIA – D1 map | 27. AUG. 2024

As soon as the action could be completed with a bullish purchase price over the mark of EUR 30.00, Vorsicht has been launched. Of course, a handler will have a good feeling when it comes to furnishing, because he or she will be happy with the “course for the training”. Let this background provide a glimpse into the value area. Here is deutsch, it is the action that disregards the value area and expands when there is a recoil. Durchschnittlich betrachtet ist der Preis daher für Einstiege zu teuer.

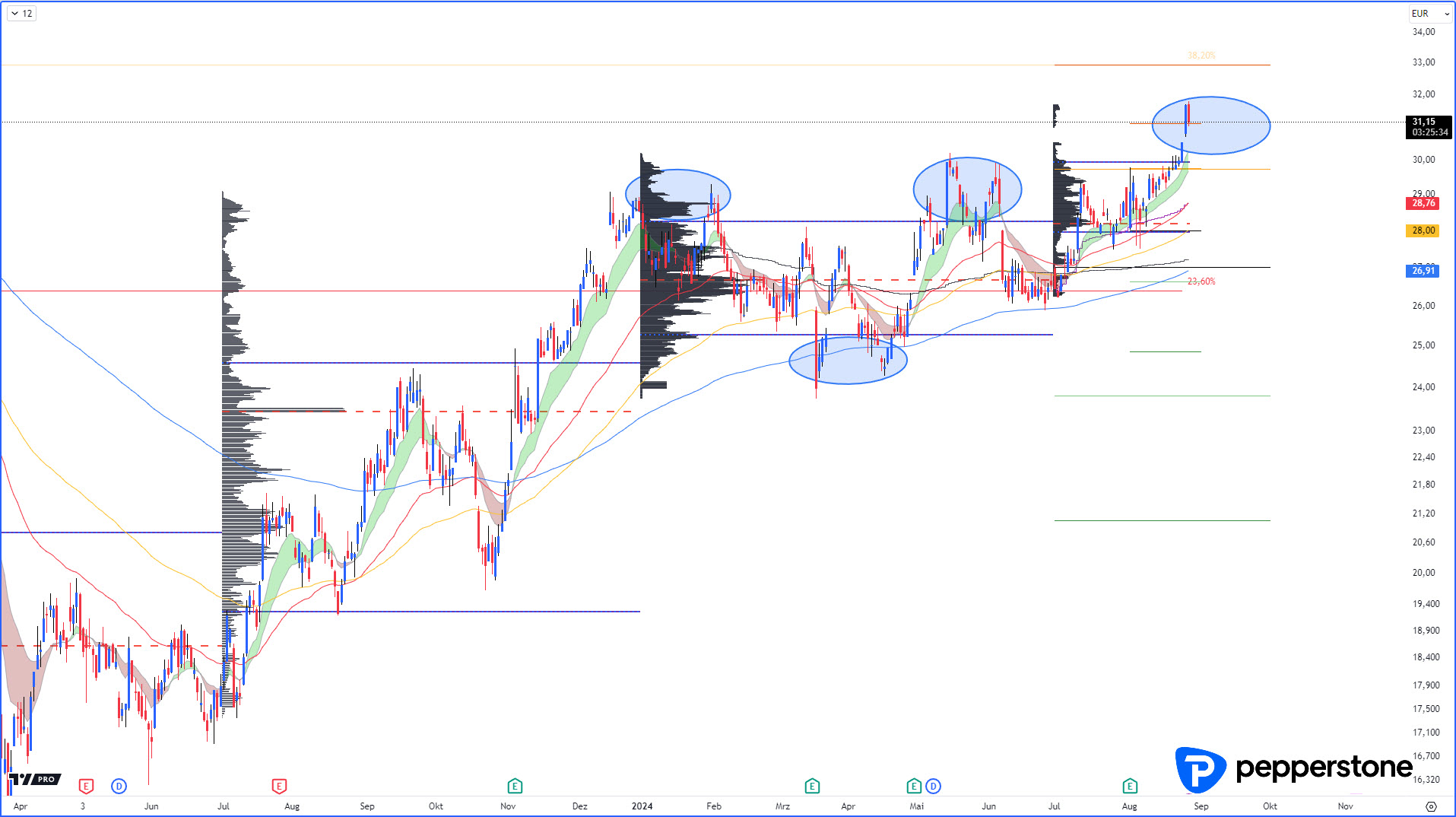

VONOVIA – D1 map | 27. AUG. 2024

Based on the value area you can see how clear the trend towards Mean Reversion is. That means, that man in the rule of the night, wenn man in these sons (also zu spät) einsteigt. Before this background is lohnt, in Trendrichtung better under the Value Area Low einzusteigen.

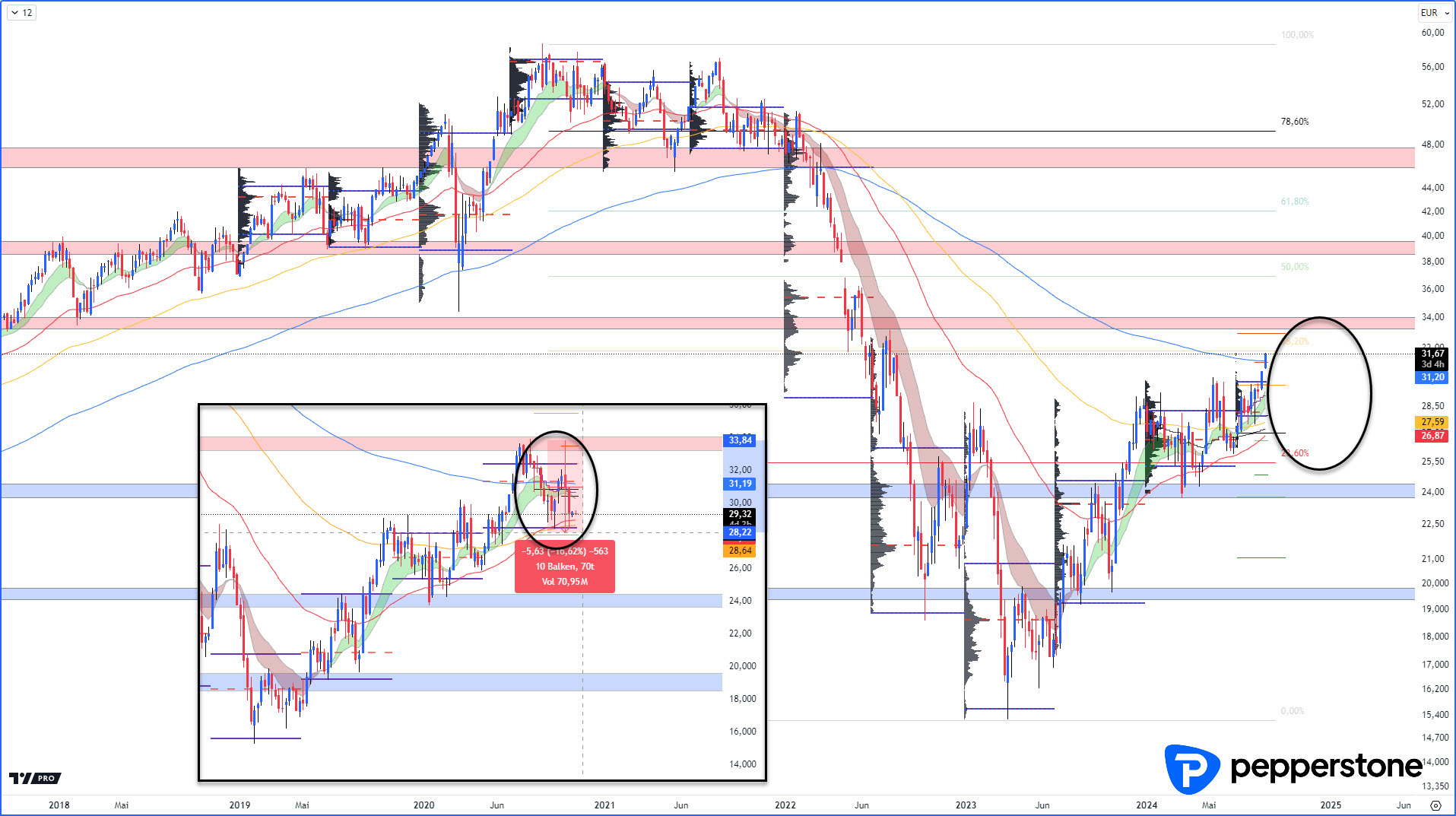

VONOVIA – D1 map | ACTUAL

Nahezu “perfekt” will replace the revised wider stand mark of EUR 34.00. About 16% of the time, VONOVIA’s action is carried out in the relevant zone. A person who is the Basic Rules for Swing Trading: Not a fallen (rising) WOCHEN-EMA-200 for trading. In combination with horizontal cross-sections, these results in higher price reactions. If you take the wrong position, this can happen. On the Tagschart it is likely that there is a bullischer Ausbruch. In the event of a liquidity trap, professional market forces continue.

Fell Erfolg,

Ihr Dennis Gürtler.

Dennis Gürtler is Gründer- and Geschäftsführer of a private trading company in Berlin. As an e-portfolio manager and fully-fledged company, it has been active in the financial market since 2008. Dennis Gürtler has been working in DACH-Raum for his expertise for 15 years.