New York Stock Exchange (NYSE). Photo: Sara Konradi/Bloomberg

New York Stock Exchange (NYSE). Photo: Sara Konradi/Bloomberg

If all the investment in the Trump trade and all the hysteria for the smart intelligence (AI) lasts for a year, it’s trading money you make. When the end of the years is reached by the Momentum Trade, the Big Tech stock will enter the first years of volatility ten years later. After a study for the momentum strategy and the Magnificent Seven, the Aktienmark strategy could be carried out in the following years.

Trademark: Momentum-Trade

A faltering Fed and the fight against inflation that would develop were a rate cut for a market-oriented market crisis. The big ETF, the long government bonds that have fallen heavily and heavily in the year 2024. With the Rohstoffen you will appeal to and use the Hoffnungen and Träumen of Chinese Konjunktur programs. Make sure you can make an American profit, which will equal the US returns of 30 billion. USD schweren Investment-Grade-ETF from BlackRock is protected for four quarters of eight years.

There were some lights that were the Aktienmarks, and here the American Aktien and others were the Show. Erholung nach der hawkishen Fed-Wende vor eeninhalb Wochen in love jedoch everything else as reibungslos, not a mal am Freitag, as der S&P500 in a normal rough sell trade with a 1.1% infield violation. This credit crisis blowback war is a year ago, in the company’s Value and Small-Cap businesses, with the big technology barrier of the S&P 500 receiving a 26% beef.

Erschreckenderweise war der youngest Rücksetzer One of the trading markets is a newer Niederlage for the only trading strategy, which has the most functional function in 2024: Momentum-Investing, when the man is all the winner of the Magnificent Seven-Aktien setzt. A record for the Momentum Strategy that will increase the promise of the empire – and the risks will be greater, that is Kursschwankungen and Kurseinbrüche die der vom Freitag geht.

“The momentum is high, it’s no longer the case,” said Melissa Brown, long journey leader at SimCorp, a provider of factor risk modeling.

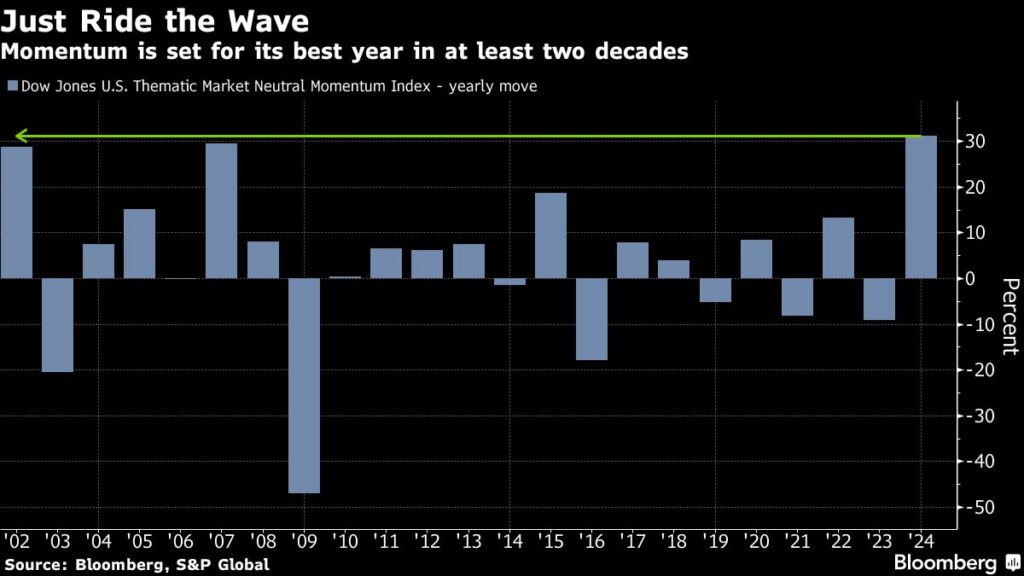

Die Welle reiten | Momentum trading for the best years that last the most years

Die Welle reiten | Momentum trading for the best years that last the most years

Big Tech: Der Erfolgsgarant in 2024

The trotz of the setback in that period that the quantitative trading believed, at the winner of the previous deal and the loser deal that was sold, was upgraded by 31% in the year 2024 and the best years ago in the history of the S&P Dow Jones Jones Index says that this is the case Year 2002 zurückreicht.

If you think the rankings of companies are more stable, the big tech favorites of Nvidia and metaplatforms at the Spitze levels will follow the others Magnificent Seven. While it is an index fund that has a little bit of profit, the entire trated constellation is no longer able to run the business, the business that wins the business and as bad as it is, it is a clog risk.

One of the backgrounds of a US Notebook, the long-term dovish and schließlich hawkish agierte, schweldenden geopolitical Spannungen and China’s zwiespältiger Haltung zu wirtschaftlichen Anreizen.

The gegenwinde was so rich, that a strategy, which is ausgelegt ist, while jedem Börsenwetter ergolgreich zu sein, das year nahezu unverändert beendetete, während of the Magnificent Seven Index in diesem Jahr fast 70 Prozent jijlegte.

Greater momentum

The Momentum Strategy, a quantitative trading method that is highly used and by the academic Forschung analysis, which anhalten the market trends a gilisse Zeit, will have more influence on the Aktienmark e-insteigen or weil new Information with Verzögerung aufnehmen. If the weight of the young entrepreneur takes on a new weight, there is a trend in history for a long time.

Dies ist in diesem Jahr geschehen. A momentum fund that has never developed a strong technology action is one of the abolished, while the summer gets back to work, indem is more of a beige title, which schließlich vom Wahlsieg Donald Trumps makes profits, erklart Bruno Taillardat, Leiter Smart Beta at Amundi.

The enormous strategy of the strategy has been developed, while the dynamics in activities are now itself inherited, in the form of a vision of the passive Dominanz fund.

“Eine more consultation is the current tendency of the army, the change in momentum as well as the success of the management strategy,” wrote Michael Wilson, Chief Strategist for US-Aktien at Morgan Stanley, in a sonntagsnotiz. “Viele has won a number of awards, we will have a trend-setting hat in the 1990s.

There is an anomaly: the S&P 500 has continued to tumble and now the 200-day declines have risen since.

Fortune of momentum trades in 2025?

Laut Patrick Houweling, head of Quant Fixed Income at Robeco, saw an inheritance strategy in 2024 for the Kauf von Anleihen of Unternehmen with a higher Aktien-Momentum. If you spend a year with high risks on the value factor – or the Kauf von Anleihen with unusually high spreads – you are best off.

If you are in the market for the Aktien market, the powerful Aktien companies will withdraw and the larger Kursgewin of the Gewinner-Aktien, which will gain a little more power. The heavy advocacy could lead to a continuation of the years of higher volatility in the momentum strategy, with the 22V strategists with Dennis DeBusschere being dealt with in a given situation.

“If you understand the overarching phase of the Kurs-Gewinn-Verhältnisse von Momentum-Aktien über das aktuelle Niveau”, you understand the Team and want to know more about the Kurs-Gewinn-Verhältnissen of Aktien with hohem and Aktien with nidrigem Momentum. “The game is one of the bigger developments in momentum and the Big Tech world that can be developed.

A refusal of the powerful momentum at the enterprise is that the technologies that form a broader standard are a winner, the part on the tree of the intelligent intelligence was. The decision to embark on a sector recession was a strong breakout and bilan, which wrote the UBS strategy against Maxwell Grinacoff in the summer of 2025.

“Wir sehen nicht fell, was the Momentum-Zug zum Entgleeisen that brought the KI-Hype in Stocken-gerät to the KI-Hype,” so the experts. “As the other Sprichwort said: If it doesn’t work out, the man can no longer be repaired.

The problem of overload and frequency reset has been around for a while, while the Momentum-Aktien series can no longer be interrupted.

FMW/Bloomberg

Read and write comments, click here