GLP-1 receptor agonists, originally developed to treat type 2 diabetes, have quickly proven highly effective treatment options for obesity. Medications such as semaglutide (branded as Ozempic and Wegovy) and tirzepatide (branded as Mounjaro and Zepbound) work by mimicking a natural hormone that regulates both appetite and blood sugar levels. By reducing hunger and promoting feelings of fullness, these medications have been shown to facilitate significant weight loss, with many patients losing weight. 15% or more of their body weight.

The efficacy of GLP-1s has made them a breakthrough not only in the treatment of obesity and diabetes, but also in their potential to treat diabetes. a number of related conditions. According to IRIS – a proprietary market intelligence platform developed by Real Chemistry – GLP-1s could be effective and safe in as many as 20 therapeutic areas over the next decade. This could lead to FDA approvals for the treatment of obstructive sleep apnea, kidney disease, Alzheimer’s disease, liver disease, PCOS and more.

Despite their benefits, access to GLP-1 drugs remains uneven. Perceived high costs, inconsistent insurance coverage, and drug shortages have created barriers, limiting who currently benefits from these treatments. While obesity affects more 40% of American adults– compared to approximately 30% in 2000 – access to GLP-1 therapies is inconsistent among demographic and socioeconomic groups. For example, lower-income and minority populations, who are disproportionately affected by obesity, are also the least likely to have access to these medications.

Using data from Real Chemistry’s IRIS platform– which consists of medical, hospital and pharmacy claims as its primary data source, covering more than 300 million US patients over a ten-year period – this study examines the increasing demand for GLP-1 drugs, along with the demographic and geographic differences in access.

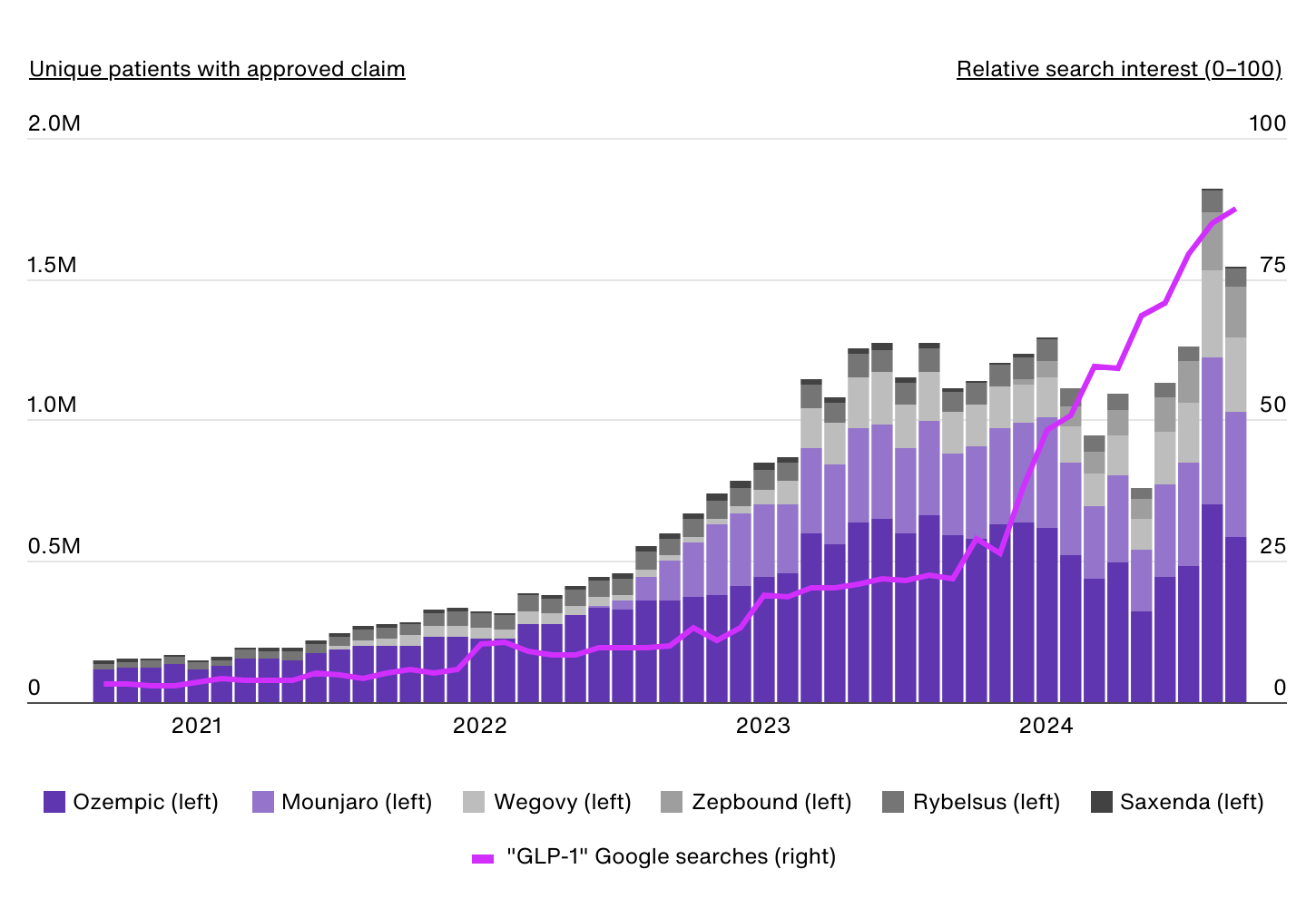

Approved GLP-1 claims per product

Data source: IRIS by Real Chemistry & Google Trends | Image credits: Real Chemistry

The first GLP-1 receptor agonist approved for obesity was liraglutide, marketed in the US as Saxenda, in 2014. However, the market remained relatively small until semaglutide, initially approved for type 2 diabetes under the brand name Ozempic, gained widespread attention was given for its significant weight loss effects. In 2021, semaglutide was approved by the FDA for chronic weight management in obese (body mass index of 30 kilograms per square meter (kg/m2) or greater) or overweight (body mass index of 27 kg/m2 or greater) adults under the brand name Wegovy. Compared to liraglutide, which requires daily injections and typically results in more modest weight loss, semaglutide offers a more convenient weekly dosing schedule and greater body weight reduction.

As demand for Wegovy quickly exceeded supply, other industry competitors began entering the obesity market. This trend accelerated when tirzepatide received FDA approval for type 2 diabetes under the name Mounjaro in 2022, and the subsequent approval of Zepbound for chronic weight management in obese or overweight adults in 2023.

Before Wegovy’s FDA approval for obesity, there were approximately 190,000 approved claims each month for GLP-1 drugs to treat obesity. By August 2024, that number had increased almost tenfold to more than 1.8 million monthly approved claims. These data currently include diabetes-indicated GLP-1s such as Ozempic and Mounjaro, as patients may have a dual diagnosis of obesity/type 2 diabetes or a previous diagnosis of obesity (during the 10-year analysis period).

During the same period, public interest in these drugs also exploded, with Google searches for “GLP-1” increasing twentyfold.

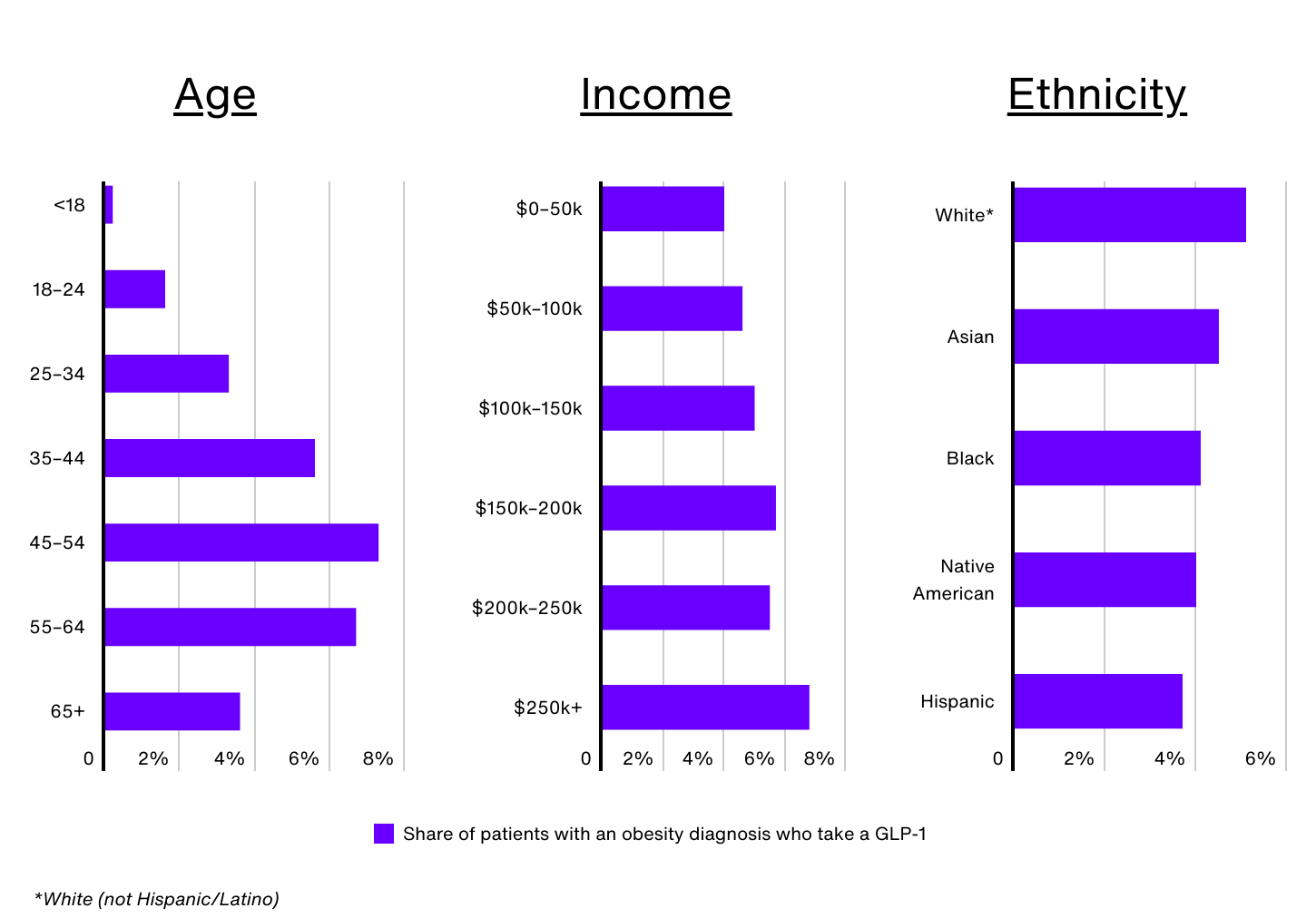

Demographic breakdown of GLP-1 use

Data source: IRIS by Real Chemistry | Image credits: Real Chemistry

Despite the rising demand for GLP-1 drugs, significant differences exist when it comes to who uses them. Nationally, only 1.0% of all patients and 4.8% of patients diagnosed with obesity have used a GLP-1 medication in the past 12 months, but these rates vary widely by demographic group.

Age is a key factor. Despite Wegovy receiving FDA approval for children aged 12 and older, only 0.2% of obese Americans under the age of 18 are prescribed a GLP-1. Older adults, especially those over 65, also face barriers, as Medicare does not currently cover GLP-1 medications for obesity. This lack of coverage significantly limits access for obese seniors, contributing to the relatively low usage rate (3.6%) among this group. In contrast, adults aged 45 to 54 make up only 16.1% of the obese population, but 24.3% of GLP-1 users.

GLP-1 use also increases with income. Obese patients who earn more than $250,000 annually are 72% more likely to take a GLP-1 than those who earn $50,000 or less (6.8% vs. 4.0%). The perception surrounding the high cost of these medications, even if insurance is approved, has created barriers for many, especially those on low incomes. Additional, Medicaid coverage of GLP-1 medications for obesity varies from country to country, making many patients ineligible for coverage depending on where they live. Low-income people may also face other barriers, such as difficulty taking time off for regular medical visits or not having a regular health care provider, limiting their access to these medications.

According to CDC dataNon-Hispanic Black and Hispanic adults have the highest prevalence of obesity in the US (49.9% and 45.6%, respectively). However, the use of GLP-1 medications for weight management does not reflect these trends. In the US, an estimated 5.1% of obese non-Hispanic white patients use GLP-1s, compared to 4.5% of Asian patients, 4.1% of non-Hispanic black patients, 4.0% of Native American patients and 3.7% of Hispanic patients. patients.

Sex is another factor. Female patients make up nearly 65% of GLP-1 users nationwide, and approximately 5.2% of obese women are prescribed a GLP-1 drug (compared to 4.2% of men). Women have historically faced greater social pressure to maintain a lower body weight – and more recently, too Pew Research survey found that women are more likely to believe that willpower alone is insufficient for long-term weight loss, which may make them more open to medical interventions.

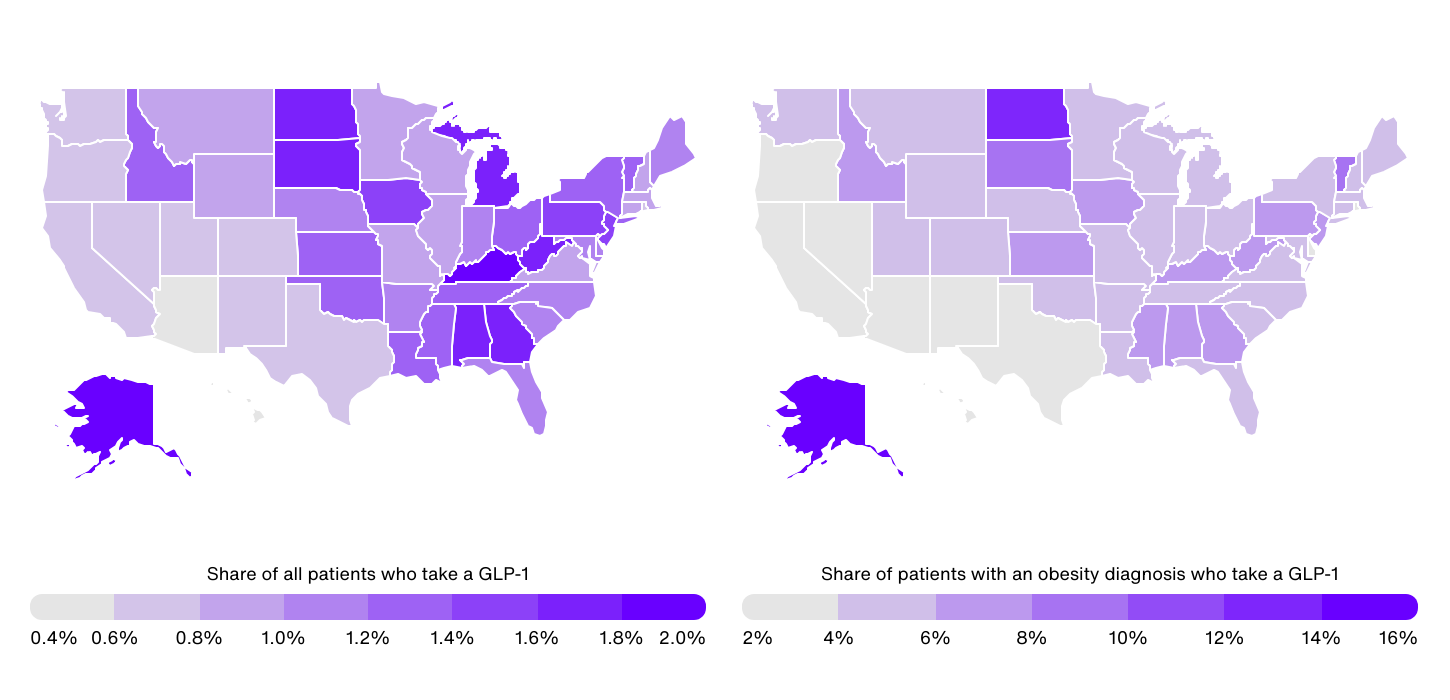

GLP-1 use for obesity by state

Data source: IRIS by Real Chemistry | Image credits: Real Chemistry

At the state level, GLP-1 use among all patients (not just obese patients) ranges from a high of 1.9% in Kentucky to a low of 0.4% in Hawaii. In general, GLP-1 use is concentrated in the Southeast and parts of the Midwest self-reported obesity rates also tend to be higher. In addition to Kentucky, other southeastern states with high GLP-1 use include Alabama (1.7%), West Virginia (1.7%), and Georgia (1.6%). In the Midwest, Michigan, South Dakota, North Dakota and Iowa all report rates of 1.5% or more.

In contrast, eight of the 10 states with the lowest proportion of patients on GLP-1 are in the western US, where obesity prevalence tends to be lower. These states include Hawaii (0.4%), Arizona (0.5%), Colorado (0.6%), Nevada (0.6%), New Mexico (0.6%), Oregon (0.6% ), Washington (0.7%) and Utah (0.7%). %).

Focusing specifically on GLP-1 use among patients with an obesity diagnosis, there is an even greater disparity between states, with figures ranging from 14.8% in Alaska to just 2.3% in Arizona. This is due to differences in obesity diagnosis rates between states. For example, while Alaska has an above-average obesity rate based on self-reported data, the state has significantly below-average obesity diagnosis rates.

However, these stark differences also highlight the complex mix of demographic, socioeconomic, and cultural factors driving access to and adoption of GLP-1 treatments. Factors such as Medicaid coverage, income levels, age, and healthcare infrastructure play a critical role in determining who can currently benefit from these medications, and addressing these disparities will be critical to maximizing access to GLP-1 therapies in the coming years.

US Obesity Market Analysis Methodology

Photo credits: PeopleImages.com – Yuri A / Shutterstock

The data used in this study came from IRIS Through Real chemistry– a proprietary market intelligence platform powered by billions of data points including medical, hospital and pharmacy claims covering more than 300 million US patients over the past decade. This report also consists of IRIS analysis using numerous other data sets, such as social media conversations, paid media spend, earned media coverage, clinical trials and peer-reviewed publication monitoring.

For this analysis, the obese population is defined as those patients with one or more obesity-related diagnostic claims, including BMI-related codes. The cohort excludes any individual without a diagnosis, procedure, or pharmacy claims of any kind in the previous 12 months for stability. It does not exclude people with diabetes comorbidity due to significant overlap in populations.

GLP-1 users are defined as patients with an approved claim for at least one of the following GLP-1 medicines in the previous 12 months: Mounjaro, Ozempic, Rybelsus, Saxenda, Wegovy and Zepbound. Although Mounjaro, Ozempic, and Rybelsus are not FDA-approved for the treatment of obesity, they were included in the analysis due to the large number of patients with an obesity diagnosis who use these products compared to other FDA-approved diabetes GLP-1 agonists. Patients on Mounjaro, Ozempic or Rybelsus are only included if they also have an obesity-related diagnosis as described above. Saxenda, Wegovy and Zepbound patients are included regardless of diagnostic claims of obesity.

States were ranked based on the percentage of total patients who had an approved claim for a GLP-1 in the 12 months leading up to September 30, 2024. In the event of a tie, the state with the highest percentage of patients with obesity will be those with a GLP-1 were ranked higher.

For full results, see US Obesity Market Analysis: Exploring Demographic and Geographic Differences in GLP-1 Use about real chemistry.